Coastal Debt: On Track To Rescue More Businesses From MCA Debt Than Anyone Else

Though MCAs can seem like a viable option during cash flow disruptions or urgent capital needs, their terms are often unsustainable.

The aggressive repayment schedules can quickly strangle a business’s operating funds, leading thousands of small businesses to failure.

Coastal Debt stands out as one of the few (BBB accredited) companies specializing in merchant cash advance settlements, offering a realistic and affordable escape route for business owners caught in this debt cycle.

Their approach involves working closely with business owners to outline a clear path toward regaining financial control.

Their process is straightforward and tailored to each business’s unique situation.

During a free, no-obligation consultation, Coastal Debt’s experts delve into the specifics of the business’s financial distress.

Upon determining that they can help, they devise a strategy to significantly reduce or entirely resolve the debt.

Coastal Debt’s debt resolution strategies are centered around key actions:

1. Stop MCA Withdrawals: Business accounts are safeguarded from further MCA withdrawals.

2. Instant Cash Flow Relief: They inject immediate cash flow into your business, giving Coastal Debt time to negotiate an optimal debt solution for your business.

3. Affordable Settlements: Coastal Debt negotiates settlements which allow you to breathe easier with comfortable weekly payments.

4. Save up to 80% on Debt Payments: Get up to 80% OFF your MCA debt payments and pay it off completely in 6-8 months.

This comprehensive process ensures complete resolution of Merchant Cash Advance debts.

Given the aggressive nature of MCA lenders, time is of the essence for businesses seeking relief.

Coastal Debt’s track record speaks for itself, but action is necessary.

If your business is struggling under the weight of MCA debt, don’t wait.

Sign up for a free, no-obligation consultation with Coastal Debt today to see if you qualify for their debt relief program.

Take the first step towards financial freedom and reclaim control over your business and your life.

For more information and to schedule your consultation, visit Coastal Debt’s website and find out how they can help your business thrive once more.

Here’s How To Check If You Qualify

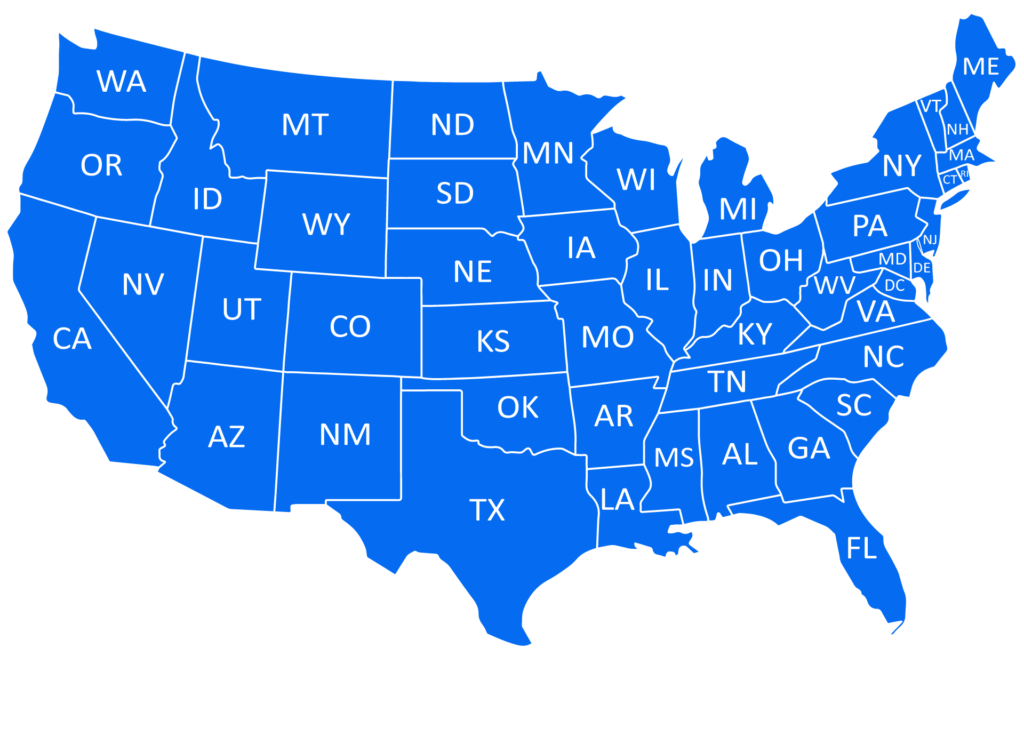

Step 1: Tap or Click on your state in the map below

Step 2: Answer 3 short questions and discover if you qualify for the program.

THIS IS AN ADVERTORIAL AND NOT AN ACTUAL NEWS ARTICLE, BLOG, OR CONSUMER PROTECTION UPDATE

The information provided in this advertorial is for educational and informational purposes only and should not be construed as financial or legal advice. The views and opinions expressed in this advertorial are those of Coastal Debt Resolve and do not necessarily reflect the official policy or position of any other agency, organization, employer or company. Examples and scenarios are illustrative only and we make no guarantee of results; individual results may vary. Coastal Debt Resolve (the Company) is not a lender or a creditor. The Company offers debt relief services that aim to assist business owners in managing and alleviating Merchant Cash Advance debt under the applicable federal and state laws. The company does not assume your debts, make monthly payments to creditors or provide tax, bankruptcy, accounting, legal advice or credit repair services. Please consult with a licensed financial advisor or attorney to discuss your specific situation before making any financial decisions. Enrollment with Coastal Debt Resolve does not guarantee that your creditors will agree to modify your debt terms or amounts. This advertorial may contain forward-looking statements, which are based on beliefs, assumptions, expectations, estimates, and projections as at the time of writing. Such statements involve risks and uncertainties, including but not limited to economic, competitive, governmental influences that may affect the business operations of Coastal Debt Resolve. Past performance is not indicative of future results. Please contact Coastal Debt Resolve directly for a consultation regarding your specific debt situation.